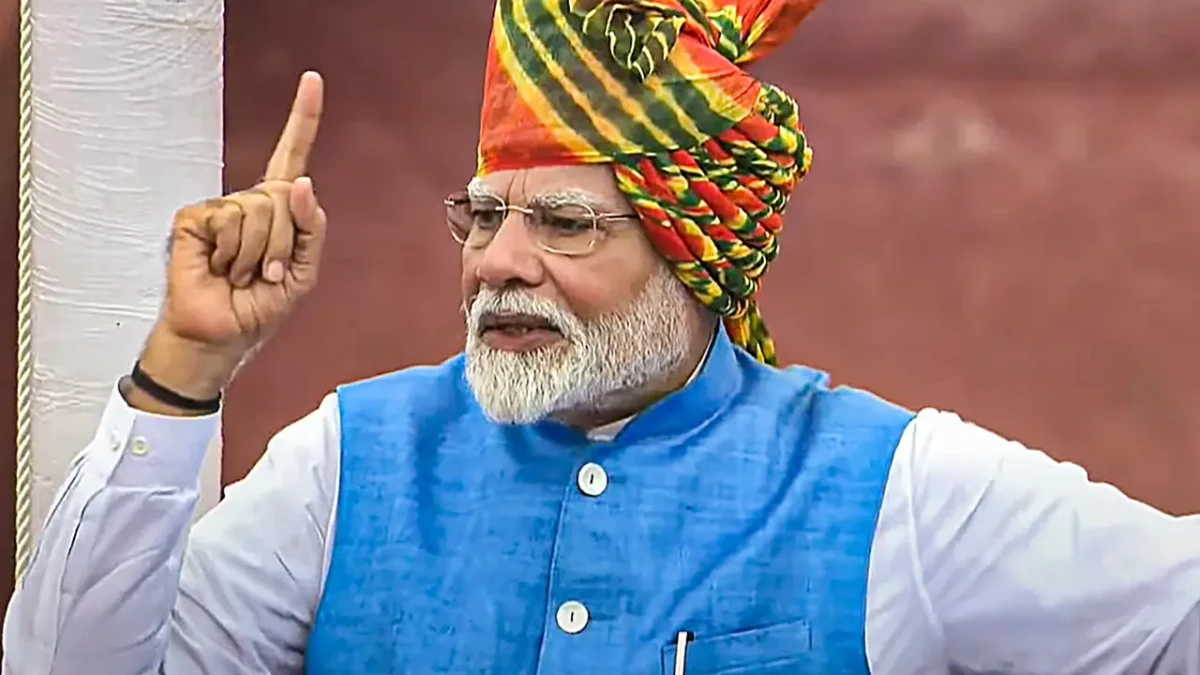

PM Modi said, “The introduction of GST in 2017 was not just a reform but the start of writing a new chapter in India’s history. For decades, both citizens and traders were trapped in a maze of multiple taxes—octroi, entry tax, sales tax, excise, VAT, service tax, and many more. Even moving goods from one city to another meant crossing numerous checkpoints.”

What Modi Announced Today

- 5% tax will be levied on essential goods and daily-use products.

- Medicines will be completely exempt from tax, ensuring greater affordability in healthcare.

- The revised tax policy will come into effect after formal notification by the government.

New GST Rates India

- Agricultural Products 5%- Earlier it was 18%

- School Products – Tax free

- Education – Tax free

- Hair Oil 5% – Earlier it was 18%

- Healthcare insurance – Tax free

- Cars – 18% Earlier – 28%

Tax Free India – Modis announcement

Relief for Households

Everyday products such as packaged food, household supplies, and other essentials will now fall under the 5% tax bracket, reducing monthly expenses for middle-class and lower-income families.

Boost to Healthcare Affordability

By exempting medicines from tax, the government aims to make critical and life-saving drugs accessible to all sections of society, especially patients struggling with long-term treatments.

Economic Implications

- Reduced tax on essentials may increase consumer spending.

- Pharmaceutical and retail industries could see higher demand due to affordability.

- This move is also likely to strengthen Modi’s welfare-driven image ahead of upcoming political milestones.

Public Reaction

The announcement has already triggered positive reactions on social media, with citizens welcoming the tax relief. Many see it as a step toward easing inflation pressures and providing direct benefits to families. Economists, however, will be closely watching how the government balances revenue needs with these tax cuts.

PM Modi’s declaration of 5% tax on essential goods and zero tax on medicines marks a significant shift in tax policy aimed at helping ordinary citizens. If implemented effectively, the move could provide immediate financial relief while improving healthcare access nationwide.